Q. Can you tell us

more about salary?

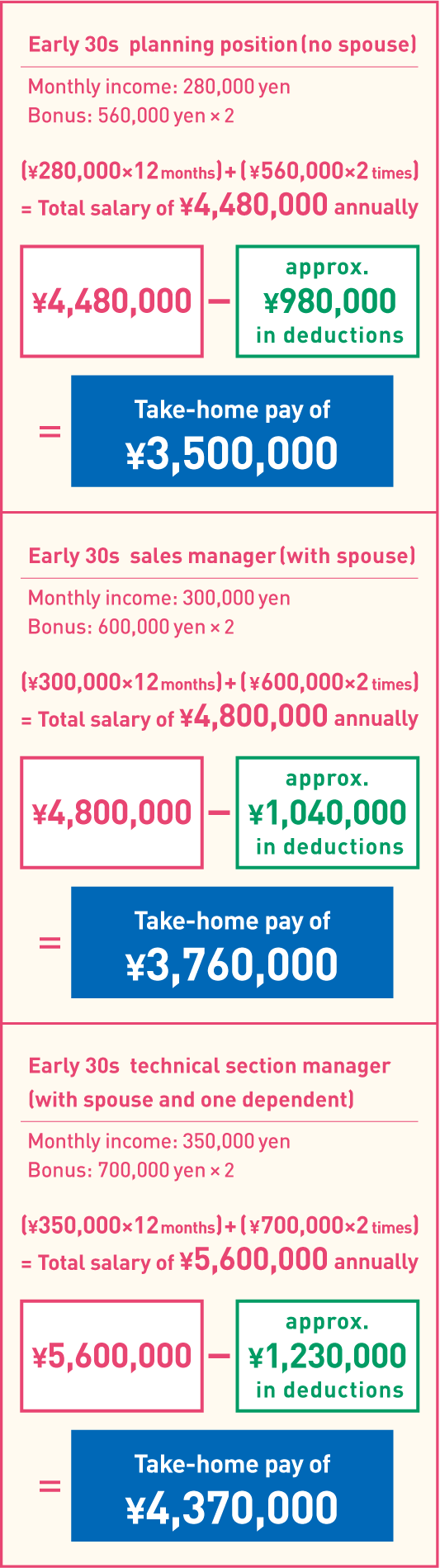

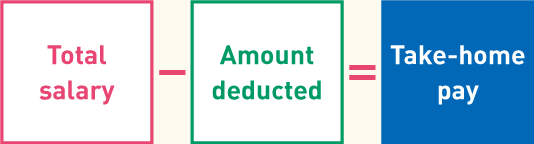

A.Salary in Japan consists mainly of monthly salary plus bonuses. Social insurance and tax payments etc. are deducted from the (gross) amount payable before the remainder is actually received by the employee as take-home pay. Bonuses are usually paid twice per year (in June and December), and the amount will vary a lot depending on the employee's performance and the company's performance―in some years, no bonus is paid at all, while in other years 4 months' worth of wages may be received.

Total salary (main items)

-

- Base salary

- The base amount as stipulated in the Notice of Working Conditions

-

- Overtime

allowance - Premium amount paid for working outside designated hours, recruitment, night work, etc.

- Overtime

-

- Transport

allowance - Covering the cost of a commuter pass etc. from home to workplace (not taxed)

- Transport

Amount deducted

- Income tax

- Residence tax

- Employment insurance

- Health insurance

- Welfare pension etc.

Example of yearly income